It lets users track business metrics that enables business owners drive profitability for both home office-based businesses to larger enterprises with more than 20 concurrent users.

Moneyworks gold 7 software#

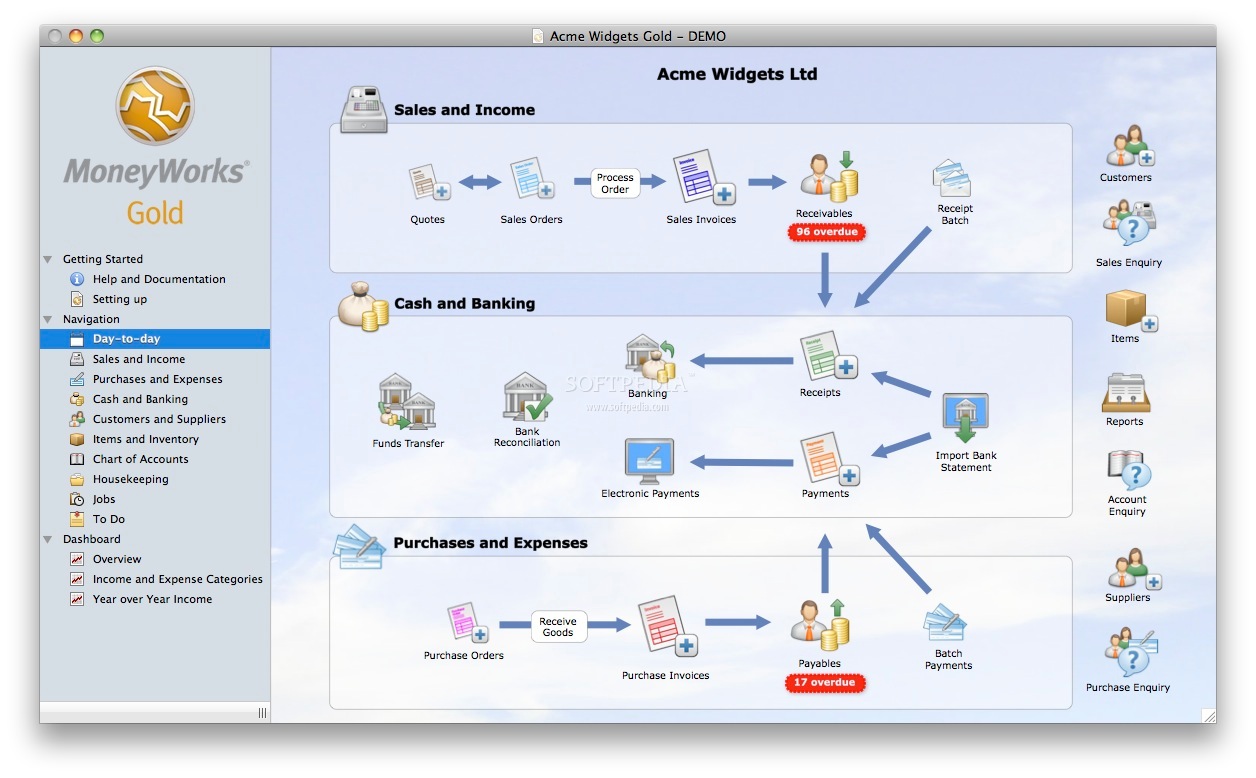

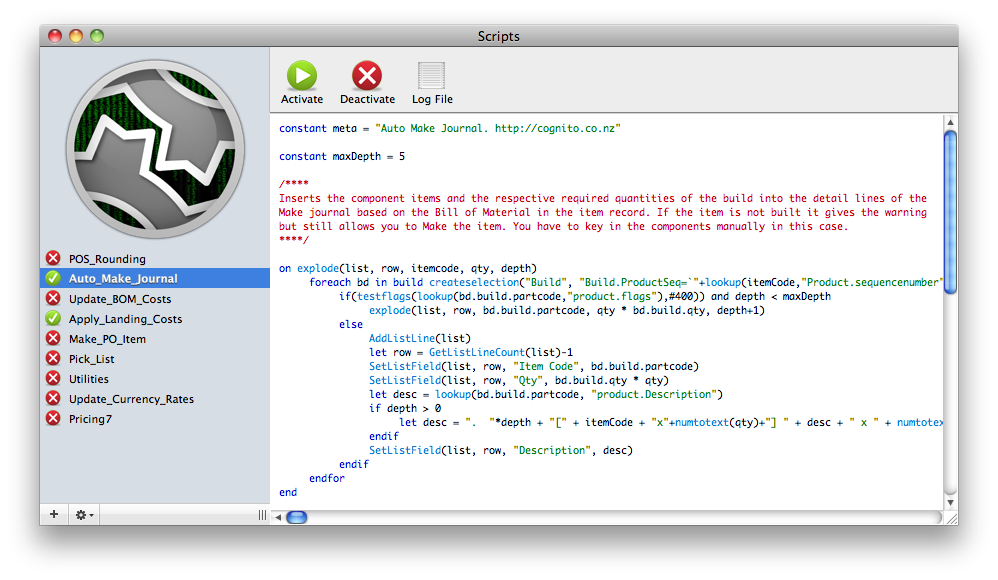

(By Abhinav Angirish, Founder, Investonline.The partnership means SGA and Simms will take the sales, marketing and distribution of the MoneyWorks family of accounting software products to small and medium businesses on both Windows and Apple platforms.ĭeveloped by Auckland-based Cognito Software in 1992, MoneyWorks is a multi-user accounting solution. In addition to meeting your short-term financial needs, the short-term investment options listed above can reduce your tax liability. The new-age digital experience not only offers convenience on the go, but also offers higher ROI on savings accounts. New-age banks offer one of the most competitive interest rates on savings accounts. In terms of taxation, POTDs are treated as bank FDs. They have a one-year lock-in, but they can always be pledged in an emergency and raised up to 75% of their value.

The Government of India fully guarantees these FDs like a bank FD. POTDs can be opened at any post office near your home for one year. In comparison with bank deposits, they are a little more tax-efficient. The risk of default and interest rate volatility is minimal. Typically, money market funds invest in short-term government instruments such as call money market, commercial paper, Treasury bills and bank CDs with maturities between three months and a year. In terms of risk, these are the lowest-risk products available in the mutual fund industry. A major advantage of arbitrage funds is that they are taxed as equity funds, although this advantage may be somewhat diluted following the 10% tax on equity funds’ long-term capital gains. In effect, this price difference is like a fixed return instrument with an annualized return of approximately 8%-9%. By buying equities and selling futures, the fund manager locks in the price difference between the two. As compared to bank fixed deposits of equal or comparable duration, these schemes tend to provide similar or slightly higher returns.Īn arbitrage fund creates debt equivalents by using equity and futures. Investors who invest for at least three months will have close to zero risk of losing money. They are ideal for anyone who wants to put money aside for a few weeks to a few months. Since these funds have a low loan duration, they are slightly higher risk than liquid funds, but they are still among the lowest-risk schemes to invest in. As soon as you redeem it, the money is deposited into your account within two to three business days.Īlso Read: Personal loans starting at 8.9% – Check offers from 24 banks in festive seasonĪn ultra-short duration fund is a debt fund that lends to companies for a period of 3 to 6 months. Liquid funds rarely see a dip in their net asset values (NAVs). Liquid funds can be used to park money as little as one day to as long as 90 days. Post-tax returns on liquid funds range between 4% and 7%. These investments are secure, so you can enter and exit at any time.

An investment in these funds can offer slightly higher returns than a savings account because they invest in money market securities maturing in 91 days. In order to build a contingency corpus, you can invest your money in liquid funds. There should be enough money in the corpus to cover a year’s expenses. It is prudent to have an emergency fund of a sizeable amount and Covid-19 made this even more important. Gurugram realty to get new momentum with the commencement of Dwarka Expressway stretch

0 kommentar(er)

0 kommentar(er)